Running a new business can be an exciting and rewarding venture, but often comes with its fair share of financial challenges. One of the biggest hurdles faced by startups and small businesses is managing cash flow effectively. However, there is a powerful solution that can help alleviate this issue – invoice finance. Invoice financing is a financing option that allows businesses to improve their cash flow by turning their outstanding invoices into immediate cash. This means that instead of waiting for customers to pay their invoices, businesses can access the funds they need to cover expenses and invest in growth opportunities right away. Whether you need funds to hire more staff, purchase inventory, or expand your operations, invoice finance can provide the flexibility and stability your new business needs. By unlocking the value of your outstanding invoices, you can gain quick access to working capital without going into debt or relying on traditional loans. In this article, we will explore the power of invoice finance for new businesses and how it can help boost your cash flow. Discover how this innovative financing solution can enable you to focus on what you do best – growing your business. What is Invoice Finance? Invoice finance is a financial solution designed to help businesses manage their cash flow by allowing them to access funds against their outstanding invoices. Essentially, this means that instead of waiting for customers to settle their bills, businesses can receive a significant portion of that money upfront. This financing option is especially beneficial for startups and small enterprises that often face cash flow constraints due to delayed payments. The principle behind invoice finance is straightforward: businesses sell their invoices to a finance provider, who then advances a percentage of the invoice value—commonly between 70% to 90%. Once the customer pays the invoice, the finance provider releases the remaining balance, minus a fee for the service. This method not only improves liquidity but also empowers businesses to invest in growth opportunities without waiting weeks or even months for customer payments. By leveraging invoice finance, businesses can maintain operational stability and avoid the pitfalls of cash flow shortages. This financing solution allows entrepreneurs to focus on their core activities—such as product development, marketing, and customer service—rather than getting bogged down by financial stress. In doing so, they can position themselves for long-term success in an increasingly competitive market. The Benefits of Invoice Finance for New Businesses Invoice finance offers a myriad of benefits, particularly for new businesses that may struggle with cash flow management. One of the most significant advantages is the speed at which funds can be accessed. Traditional loans often involve lengthy approval processes, requiring extensive documentation and collateral. In contrast, invoice finance can provide quick access to cash, allowing businesses to meet urgent financial obligations such as payroll, supplier payments, or operational costs. Another key benefit is the flexibility it offers. Invoice finance allows businesses to draw on funds as needed, which means they can manage their cash flow more effectively. This flexibility is crucial for startups that may have fluctuating income streams or seasonal sales patterns. By converting outstanding invoices into immediate cash, businesses can navigate through tight financial periods without resorting to more destructive measures, such as cutting back on essential operations or laying off staff. Moreover, invoice finance can enhance a business’s credit profile. By consistently meeting their financial obligations through this method, businesses can build a positive payment history, which could make it easier to obtain additional financing in the future. This can be particularly beneficial for startups that may not have an established credit history, helping them to establish credibility with banks and other financial institutions. How Does Invoice Finance Work? The process of invoice finance typically involves several straightforward steps. Initially, a business submits its outstanding invoices to a finance provider. The provider assesses the invoices and determines the amount they are willing to advance based on the creditworthiness of the customers and the terms of the invoices. Once an agreement is reached, the finance provider advances a predetermined percentage of the invoice amount, often within 24 to 48 hours. Once the business receives the advance, it can use the funds immediately. As customers pay their invoices, the finance provider collects the payment directly. After receiving the full payment, the provider releases the remaining balance to the business, minus any agreed-upon fees. This structure not only streamlines cash flow but also allows businesses to focus on their core operations without worrying about collections. It’s also important to note that invoice finance can be tailored to fit a business’s specific needs. Providers often offer different levels of involvement in the collection process. Some businesses may prefer to maintain control over customer relationships and collect payments themselves, while others may opt for a more hands-off approach, allowing the finance provider to handle collections. This choice allows businesses to select a financing solution that aligns with their operational preferences and customer engagement strategies. Types of Invoice Finance Available There are primarily two types of invoice finance: factoring and invoice discounting. Both options provide businesses with immediate cash flow relief, but they differ in how they operate and the level of customer interaction involved. Factoring involves selling invoices to a finance provider, who then takes over the responsibility of collecting payments from customers. This means that the finance provider manages the sales ledger and communicates directly with customers regarding outstanding payments. While this option can free up time for business owners, it may also mean that customers are aware of the financing arrangement, which could affect their perception of the business. On the other hand, invoice discounting allows businesses to retain control over their sales ledger and customer relationships. In this arrangement, the business continues to collect payments from customers, using the funds advanced by the finance provider to manage cash flow. This option is often preferred by businesses that value their customer relationships and want to maintain a level of confidentiality regarding their financing

Boost Cash Flow with Invoice Factoring

In the dynamic world of manufacturing, financial flexibility is key to driving growth, managing cash flow, and sustaining daily operations. For many manufacturing companies, capital constraints can be a common hurdle due to the capital-intensive nature of the industry. Between covering production costs, inventory purchases, payroll, and other operating expenses, manufacturing companies often face cash flow shortages, especially if they offer credit terms to their customers. Invoice factoring has emerged as an innovative and highly practical financing solution, specifically designed to address these cash flow challenges. This alternative funding method enables manufacturers to access immediate cash by leveraging outstanding invoices, making it an effective tool for maintaining financial health, expanding operations, and supporting steady growth. In this blog post, we’ll explore how invoice factoring works, why it’s particularly beneficial for manufacturing companies, and how it can empower manufacturers to tackle the unique challenges they face. Understanding Invoice Factoring Invoice factoring, or accounts receivable factoring, is a financing arrangement in which a company sells its unpaid invoices to a third party, known as a factor, at a discounted rate. This allows businesses to receive immediate cash instead of waiting for customers to pay according to their standard credit terms, which may range from 30 to 90 days or more. In a typical factoring arrangement, the manufacturing company submits its invoices to the factoring company, which then advances a percentage (usually between 70-90%) of the invoice value upfront. Once the customer pays the invoice, the factor releases the remaining balance to the manufacturer, minus a small factoring fee. This approach provides manufacturers with a steady cash flow, which can be critical to meeting day-to-day expenses, fueling growth, and enhancing operational stability. Why Invoice Factoring is Ideal for Manufacturing Companies Manufacturing companies often deal with long sales cycles and extended credit terms, which can lead to cash flow gaps that impede operations and growth. Here’s why factoring is especially advantageous for manufacturing: Managing Capital-Intensive Operations Manufacturing involves significant upfront costs, including raw materials, labor, equipment maintenance, and logistics. These expenses must be met regardless of whether customers have paid their invoices. Factoring enables manufacturers to bridge the gap between expenses and incoming revenue by providing immediate funds based on pending invoices. This working capital ensures smooth operations without disruption, keeping production lines active and delivering goods on time. Overcoming Long Payment Cycles In the manufacturing sector, it’s common for companies to offer clients extended payment terms to secure large contracts and foster long-term partnerships. However, while these terms might be favorable for customers, they can strain a manufacturer’s cash flow. Factoring accelerates cash inflows, allowing companies to receive payments on invoices within days, rather than months. This immediate access to cash helps avoid cash crunches, supporting continuous growth without waiting for customer payments. Avoiding Additional Debt One of the most appealing aspects of factoring is that it doesn’t add debt to the balance sheet. Unlike traditional loans, factoring is a sale of receivables, not a loan. This distinction means manufacturers don’t accumulate liabilities or need to make interest payments. By keeping the balance sheet debt-free, manufacturers can maintain stronger financial health, a favorable credit rating, and more borrowing capacity if additional financing is needed in the future. How the Invoice Factoring Process Works The factoring process is simple and can be tailored to meet the needs of manufacturing companies. Here’s a step-by-step look at how it works: Invoice Creation The manufacturing company generates an invoice after delivering goods or completing services for a customer. The invoice includes a payment period, typically ranging from 30 to 90 days. Invoice Submission to the Factor The manufacturer submits the invoice(s) to the factoring company, initiating the factoring process. Most factors will assess the customer’s creditworthiness to gauge the likelihood of payment, which determines the advance rate and fees. Receiving the Cash Advance After verifying the invoice, the factoring company advances a percentage of the invoice amount (usually between 70-90%) to the manufacturer, providing immediate working capital. Customer Payment and Final Settlement When the customer pays the invoice, the factor releases the remaining balance to the manufacturer, minus a small factoring fee. This fee typically ranges from 1-5%, depending on factors such as industry, customer payment history, and invoice amount. This process not only delivers fast access to cash but also transfers responsibility for collections to the factor, allowing manufacturers to focus on core operations without worrying about follow-up on payments. Types of Invoice Factoring Solutions for Manufacturing Companies Different types of factoring solutions offer flexibility to manufacturers, depending on their specific needs and financial situations: Recourse vs. Non-Recourse Factoring Recourse Factoring: In this arrangement, the manufacturer is ultimately responsible if the customer fails to pay the invoice. This type of factoring often comes with lower fees since the risk for the factor is lower. Non-Recourse Factoring: Here, the factoring company assumes full responsibility for any unpaid invoices. This type of factoring is more costly but provides peace of mind for the manufacturer, as the risk of non-payment is absorbed by the factor. Spot Factoring vs. Whole Ledger Factoring Spot Factoring: Manufacturers can choose to factor individual invoices as needed, rather than committing to all invoices. This option offers flexibility but may come with slightly higher fees due to the customized nature of the service. Whole Ledger Factoring: For manufacturers needing consistent cash flow, whole ledger factoring allows all invoices to be factored, ensuring ongoing liquidity. Advance Rate Factoring Advance Rate Factoring: In some cases, manufacturers can negotiate the percentage of the advance payment based on invoice values and customer reliability. Higher advance rates provide more upfront cash, which is particularly useful for manufacturers with substantial upfront costs. Benefits of Invoice Factoring for Manufacturers Invoice factoring delivers a wide range of advantages, making it a valuable financial tool for manufacturing companies. Here are some key benefits: Enhanced Cash Flow and Liquidity The most immediate benefit of factoring is improved cash flow. Access to fast, predictable funding enables manufacturers to handle payroll, inventory, rent, and other

Factoring for Better Cash Flow and Profitability

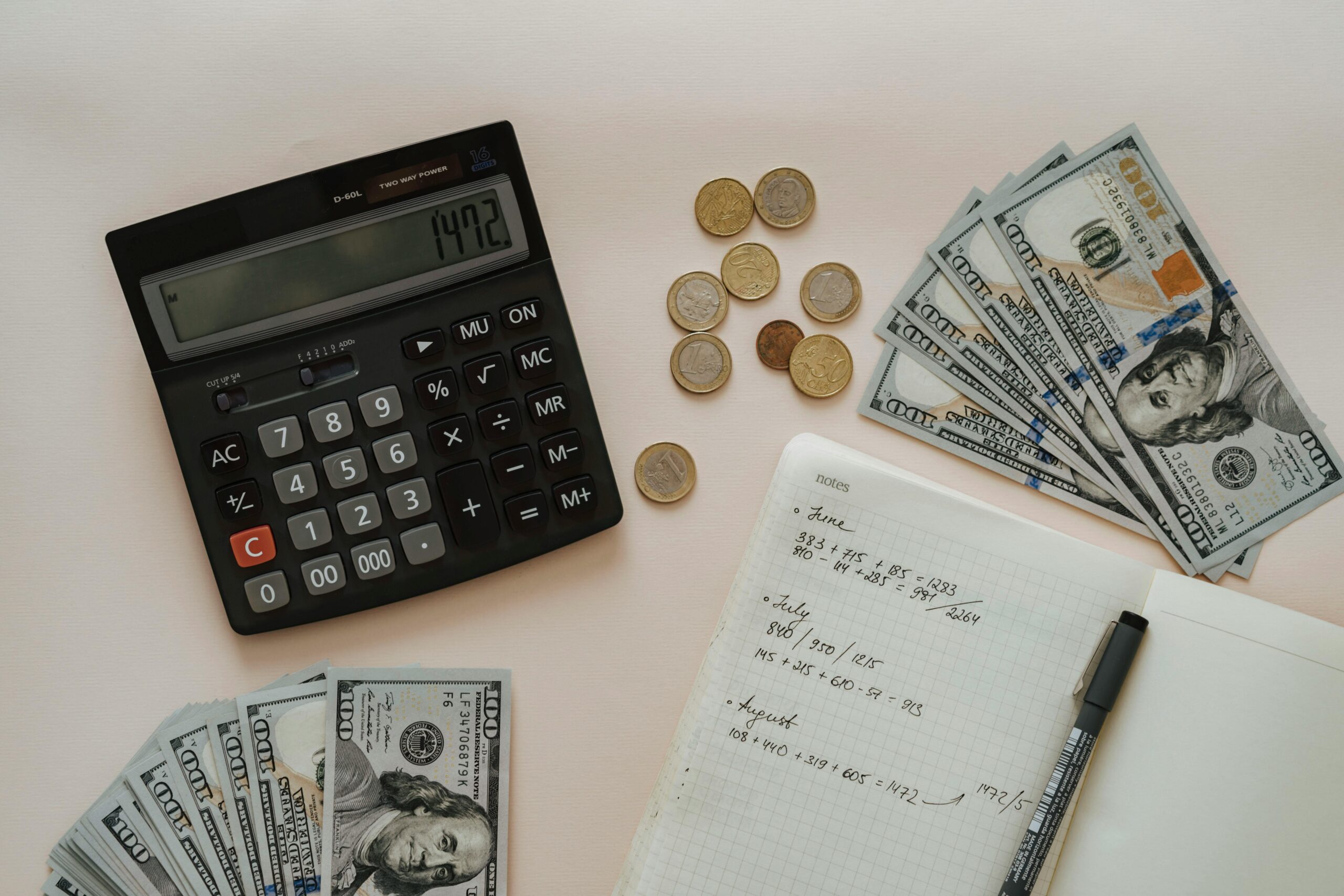

In running a business, two financial indicators are often at the forefront of business owners’ minds: cash flow and profit. Both metrics are essential for healthy business operations, yet they serve different purposes and are affected by different factors. Understanding the distinction between cash flow and profit, as well as how factoring can improve both, can be transformative for a business. Understanding Cash Flow and Profit Cash Flow is the measure of cash that flows in and out of a business within a given period. It indicates whether a business has enough cash on hand to cover expenses and meet obligations as they come due. A positive cash flow means more cash is coming in than going out, while negative cash flow can lead to a liquidity crunch. Profit, on the other hand, is the amount of money left after all expenses have been deducted from revenue. Profitability is crucial for long-term success and is typically measured as gross profit, operating profit, or net profit. Unlike cash flow, profit doesn’t necessarily mean cash in hand, as sales might be made on credit with payments pending. Cash Flow vs. Profit: Key Differences Timing: Cash flow measures the immediate cash available, while profit reflects financial health over a specific period and may not include cash received yet. Purpose: Positive cash flow keeps operations running daily, while profit sustains growth and signals long-term viability. Management: Cash flow management ensures bills and salaries are paid on time. Profit management, however, focuses on maximizing revenue and minimizing expenses to build a more sustainable business. Challenges Businesses Face with Cash Flow and Profit Even profitable businesses can experience cash flow problems. For instance, if sales are made on credit, a company could show a profit but still lack sufficient cash to cover immediate expenses. Delayed payments, high operating costs, and seasonal sales cycles are common issues that strain cash flow. In many cases, these challenges can inhibit a business’s ability to grow, hire, or even operate smoothly. What is Factoring? Factoring, or invoice factoring, is a financing solution where a business sells its accounts receivable (invoices) to a third party, known as a factor, at a discount. This allows businesses to access immediate cash instead of waiting 30, 60, or even 90 days for clients to pay. The factoring company assumes the responsibility of collecting from the client, giving the business instant access to working capital. How Factoring Can Improve Both Cash Flow and Profit Boosting Cash Flow for Operational Needs: Factoring immediately turns invoices into cash, allowing businesses to meet obligations without waiting for clients to pay. This increased liquidity can cover payroll, buy inventory, and handle day-to-day expenses, leading to a positive cash flow. Supporting Growth and Expansion: By eliminating cash flow delays, businesses can reinvest in their operations and expand with confidence. Access to immediate funds enables the pursuit of larger contracts, higher inventory levels, and capital improvements—ultimately helping to drive more profit. Minimizing Debt and Interest Costs: Unlike loans, factoring doesn’t increase debt, so there’s no need to worry about interest costs or strict repayment terms. Factoring improves the cash position without creating long-term liabilities, which can positively impact profit margins by reducing interest expenses. Enhanced Credit Control and Collection Efficiency: With a factoring company handling collections, businesses can free up time and resources to focus on their core operations. Many factoring companies also offer credit checks on potential customers, helping businesses to reduce credit risk and avoid potential bad debts. Better Planning and Financial Stability: Steady cash flow from factoring allows businesses to plan more effectively, creating stability even during slow seasons. This predictability helps with long-term financial planning, allowing businesses to take advantage of opportunities when they arise and maximize profitability. Is Factoring Right for Your Business? While factoring has clear benefits for cash flow and profit, it may not suit every business. It’s essential to consider factors such as your industry, customer base, and current cash flow needs. If your business operates with extended payment terms or experiences cash flow constraints due to delayed payments, factoring can be an effective solution. Conclusion Balancing cash flow and profit is essential for any business aiming for sustained growth. Factoring provides an effective means to stabilize cash flow while supporting profitability by eliminating delays in payments. For businesses looking to improve liquidity without increasing debt, factoring offers a flexible and powerful solution that aligns with growth and operational needs. Cash flow and profit are both critical to a business’s financial health. Factoring bridges the gap between these two by turning outstanding invoices into immediate cash, allowing businesses to keep their operations running smoothly while paving the way for long-term profitability.

Boosting Cash Flow in Economic Downturns

Economic downturns are about as delightful as a surprise root canal. Cash flow dries up faster than a pool party in the Sahara, and customers suddenly become payment ninjas, disappearing with your invoices like smoke bombs. But fear not, fellow entrepreneur! Before you start hoarding ramen noodles and practicing your “woe is me” speech, there’s a secret weapon lurking in your accounting arsenal: Accounts Receivable Financing (A/R Financing). This isn’t your grandpa’s dusty finance textbook. A/R Financing is like a magic money machine that injects much-needed cash flow into your business by leveraging your outstanding invoices. (Think of instant access to the money your customers already owe you!) Now, before you start picturing money raining from the sky (wouldn’t that be nice?), let’s unpack the nitty-gritty of A/R Financing and how it can help you not just survive, but actually thrive during those oh-so-charming economic downturns. Why Do Economic Downturns Make Accounts Receivable a Nightmare? Economic downturns are like bullies in the schoolyard of business. They pick on the weak (businesses with slow-paying customers) and leave them with a black eye (cash flow problems). Here’s why downturns make A/R such a headache: Customers Tighten Their Belts: Consumers become more cautious with spending, leading to delayed payments or worse, defaults. Sales Slump: Downturns often mean fewer sales, creating a domino effect where shrinking revenue leads to even slower collections. Increased Competition: A struggling economy breeds desperate competitors, who might offer extended credit terms to steal your customers (and your cash flow). How Does Accounts Receivable Financing Help? A/R Financing throws a ninja star right into the face of those downturn bullies! Here’s how it works: Instant Cash Flow: You sell your outstanding invoices to a finance company at a discount, receiving immediate cash to keep your business afloat. Improved Liquidity: This cash injection helps you meet your financial obligations, cover payroll, and maintain operations during a slowdown. Reduced Stress: Knowing you have access to immediate cash can alleviate the anxiety of chasing down late payments, freeing you to focus on running your business. Enhanced Negotiation Power: With A/R Financing as a safety net, you can negotiate stricter payment terms with suppliers, potentially improving your overall cash flow management. But Wait, There’s More! (There always is, right?) A/R Financing isn’t just a one-trick pony. It can also be a strategic tool for growth: Fuel Expansion: This cash influx can help you invest in new opportunities, like marketing initiatives or product development, even during challenging economic times. Maintain Inventory Levels: Don’t let a cash flow squeeze impact your ability to meet customer demand. AR Financing ensures you have the resources to maintain adequate inventory. Take Advantage of Discounts: Economic downturns can create opportunities for bulk purchases at discounted rates. A/R Financing can help you seize these deals without straining your cash flow. Is A/R Financing Right for You? A/R Financing isn’t a one-size-fits-all solution. Here are some things to consider before diving in: The Health of Your Accounts Receivable: Focus on invoices from creditworthy customers with a good history of timely payments. The Cost of Financing: Interest rates and fees associated with A/R Financing can vary. Shop around for the best deal. Your Business Model: A/R Financing works well for businesses with predictable invoice cycles and reliable customer payment patterns. Pro Tip: Don’t wait until you’re drowning in unpaid invoices! Consider A/R Financing as a proactive strategy to weather economic storms and fuel your business growth. Here are some additional tips for using A/R Financing effectively: Develop a Creditworthy Customer Base: Screen your customers carefully to minimize the risk of bad debt. Maintain Clear Communication: Communicate your payment terms clearly to customers and enforce them consistently. Invest in Technology: Utilize invoicing and accounts receivable software to streamline your collections process. The Takeaway: Don’t Be a Downturn Statistic!

Factoring: A Smart Growth Strategy

In the fast-paced world of business, cash flow is the lifeblood that keeps your operations running smoothly and supports growth initiatives. However, managing cash flow can often be a daunting task, especially when your receivables are tied up in unpaid invoices. This is where factoring comes into play, offering a viable solution to unlock cash flow and propel your business forward. In this blog post, we’ll delve into what factoring is, how it works, and the numerous benefits it can provide to your business. Factoring, also known as invoice factoring or accounts receivable financing, is a financial transaction where a business sells its unpaid invoices to a factoring company at a discount. In return, the business receives an immediate cash advance, usually around 70-90% of the invoice value, while the factoring company takes over the responsibility of collecting payment from the customers. How Does Factoring Work? Benefits of Factoring Immediate Cash Flow: The most significant advantage of factoring is the immediate boost to your cash flow. Instead of waiting 30, 60, or even 90 days for customer payments, you get a substantial portion of your invoice value upfront. This enables you to meet immediate financial obligations, invest in growth opportunities, and maintain smooth operations. Improved Working Capital: By unlocking cash tied up in receivables, factoring improves your working capital position. This enhanced liquidity allows you to take advantage of supplier discounts, manage payroll efficiently, and respond swiftly to market opportunities. No Debt Incurred: Factoring is not a loan, so it doesn’t add to your debt burden. There are no monthly repayments or interest charges to worry about, and your balance sheet remains healthy. This can be particularly advantageous for businesses that may not qualify for traditional bank loans. Outsourced Collections: Chasing late payments can be time-consuming and stressful. With factoring, the responsibility of collections shifts to the factoring company. This allows you to focus on core business activities, such as sales, marketing, and customer service, while the factoring company handles the hassle of collecting payments. Flexibility: Factoring is a flexible financing option that can grow with your business. As your sales increase, so does the amount of financing available through factoring. This scalability ensures that your cash flow keeps pace with your business growth. Strengthened Supplier Relationship: With improved cash flow, you can pay your suppliers on time or even earlier, strengthening your relationships with them. This can lead to better credit terms, bulk purchasing discounts, and enhanced supplier loyalty. Competitive Edge: Access to immediate cash flow can give your business a competitive edge. You can invest in new projects, expand your product lines, enter new markets, and take advantage of time-sensitive opportunities that your competitors might miss due to cash flow constraints. Is Factoring Right for Your Business? While factoring offers numerous benefits, it may not be suitable for every business. Here are a few considerations to keep in mind: Conclusion Factoring can be a powerful tool to unlock cash flow and fuel your business growth. By providing immediate access to funds, improving working capital, and offering flexibility, factoring helps you overcome cash flow challenges and seize growth opportunities. If managing cash flow is a persistent challenge for your business, exploring factoring could be a strategic move to ensure sustained growth and operational efficiency. Unlock the potential of your business today by considering factoring as a viable financial solution. With the right factoring partner, you can turn your outstanding invoices into immediate cash flow and set your business on the path to success.

Business Financing: What Lenders are looking for

So, you’ve got a business idea that’s hotter than a habanero pepper on a summer day. You’ve crafted a business plan that would make Steve Jobs weep with pride. But there’s one hurdle left: convincing a lender to actually hand over the cash. Let’s face it, lenders aren’t handing out money like candy at a parade. They’re more like financial ninjas, meticulously analyzing your business before deciding if you’re worthy of their secret stash of cash. But fear not, fearless entrepreneur! This guide will translate the cryptic language of lenders and reveal exactly what they’re looking for when you walk into their lair (or, more likely, send them a meticulously crafted loan application). The 5 C’s of Credit: The Lender’s Holy Grail Lenders base their decisions on a set of criteria known as the “5 C’s of Credit.” Think of them as the five keys that unlock the treasure chest of business financing. 1. Character: Are You Trustworthy? This goes beyond just having a good credit score (although that definitely helps!). Lenders want to see a strong track record, both personally and professionally. They’ll assess your experience in your industry, your ability to manage finances, and your overall business acumen. Basically, they want to know if you’re the kind of person who can handle the responsibility of a loan. Pro Tip: Showcase your experience and expertise in your business plan. Highlight any relevant past successes and demonstrate your passion for the venture. 2. Capacity: Can You Handle the Loan? This dives into the financial nitty-gritty. Lenders want to know if your business has the capacity to repay the loan. They’ll scrutinize your financial projections, cash flow statements, and historical financial performance. Pro Tip: Develop a detailed financial forecast that projects your revenue, expenses, and profitability for the foreseeable future. Be realistic and conservative – lenders don’t like overly optimistic projections. 3. Capital: Skin in the Game? Lenders want to see that you’re invested in your business beyond just wanting a piece of their pie. They’ll look at your personal financial contributions – how much of your own money have you invested? This demonstrates your commitment and reduces their risk. Pro Tip: Don’t go into your loan application empty-handed. Show lenders proof of any personal investments you’ve made in your business. 4. Collateral: Something to Hold Onto (Just in Case) Collateral acts as a safety net for lenders. It’s an asset (like property or equipment) that the lender can seize if you default on the loan. While not always required, having valuable collateral can improve your chances of loan approval and potentially secure a lower interest rate. Pro Tip: If you have valuable assets, highlight them in your loan application. However, even businesses with limited collateral can still qualify for loans, especially with strong financials and a compelling business plan. 5. Conditions: The Loan Lowdown This refers to the specific terms of the loan, such as the interest rate, repayment schedule, and loan amount. Lenders will consider the overall economic climate, the industry you operate in, and your business’s risk profile when determining these conditions. Pro Tip: Be prepared to negotiate the loan terms. Research average interest rates for your industry and loan type to ensure you’re getting a fair deal. Beyond the C’s: Bonus Points for Loan-Worthy Businesses While the 5 C’s are the foundation, there are other factors that can tip the scales in your favor: The Art of the Loan Application: Packaging Yourself for Success Here are some final tips to craft a loan application that screams “fund me!”: Remember, lenders are people too (well, most of them). Build rapport, show passion for your venture, and convince them that you’re a worthy investment.

Smart Business Loans for Small Businesses

So, you’ve got a dream, a business plan that would make Richard Branson jealous, and the drive to make it big. But that dream needs fuel – cold, hard cash (and maybe a few gallons of ambition-infused coffee). The answer? A small business loan. But let’s face it, navigating the loan landscape can feel like wandering through a financial labyrinth guarded by a fire-breathing dragon (a.k.a. the loan officer). Fear not, fearless entrepreneur! This guide will equip you with the knowledge and tools to slay the dragon and emerge victorious (with a loan in hand). Step One: Know Yourself (and Your Business Needs) Before you even think about applying, take a deep dive into your own financial situation and the specific needs of your business. Here’s the lowdown: How much money do you actually need? Don’t overestimate – be realistic about your startup costs or expansion plans. What type of loan is right for you? Term loans, SBA loans, equipment financing – each has its own pros and cons. Research your options! Get your financials in order. Lenders are number fanatics, so dust off those dusty spreadsheets and prepare clear financial statements. Pro Tip: Don’t be afraid to seek professional help from an accountant or financial advisor. They can help you understand your financial situation and recommend the best loan options. Step Two: Craft a Business Plan Worthy of a Standing Ovation Your business plan is your battle cry, your declaration of awesomeness. It’s what will convince the loan officer that your business is a worthy investment. Here’s what your plan should include: Executive Summary: A concise overview of your business, its mission, and its potential. Market Analysis: Demonstrate your understanding of your target market, competition, and industry trends. Products/Services: Clearly explain what you offer and what makes it unique. Management Team: Highlight the skills and experience of your team members. Financial Projections: Develop realistic forecasts for your revenue, expenses, and profitability. Pro Tip: Make sure your business plan is well-written, professional, and easy to understand. Remember, you’re trying to impress a (potentially) skeptical audience. Step Three: Research, Research, Research! Don’t just jump at the first loan offer that comes your way. Shop around and compare options from different lenders, including banks, credit unions, online lenders, and alternative financing platforms. Here are some key factors to consider when comparing loans: Interest Rates: This is the cost of borrowing the money. Lower is better, obviously. Loan Terms: This includes the repayment schedule, collateral requirements, and any prepayment penalties. Eligibility Requirements: Make sure you meet the lender’s qualifications before wasting your time. Pro Tip: Utilize online resources and loan comparison tools to streamline your research and identify the best loan options for your needs. Step Four: Dress for Success (Even Loan Applications Need Style) Presentation matters! Here’s how to make your loan application stand out: Be complete and organized. Include all the required documentation and ensure everything is up-to-date. Proofread your application! Typos and grammatical errors scream unprofessionalism. Tailor your application to each lender. Highlight the aspects of your business that align with their specific lending criteria. Pro Tip: Consider including a compelling cover letter that introduces your business and reiterates your passion and commitment to success. Step Five: Be Prepared to Answer the Dragons’ Questions Loan officers will likely have questions about your business, your financial projections, and your experience. Here are some tips for acing the interview: Be confident and enthusiastic. Show the loan officer you truly believe in your business. Practice your pitch beforehand. Be clear, concise, and passionate about your vision. Be honest and transparent. Don’t try to sugarcoat any weaknesses – it will only hurt your credibility. Pro Tip: Anticipate potential questions and prepare answers beforehand. This will demonstrate your preparedness and professionalism.

Understanding Interest Rates for Business Loans

Let’s face it, business loans are the fuel that propels your entrepreneurial dreams. But that fuel doesn’t come cheap. Lurking in the shadows of loan agreements is a sneaky little villain called the interest rate. It can make the difference between a smooth, profitable journey or a debt-fueled nightmare. But fear not, fearless entrepreneur! This guide will transform you from an interest rate rookie to a savvy negotiator, ready to land the sweetest loan deal this side of Wall Street. The Interest Rate Rollercoaster: What it is and Why it Matters An interest rate is basically the price you pay to borrow money. It’s expressed as a percentage of the loan amount and is charged annually (that’s the “annual” part in APR – Annual Percentage Rate). Think of it as the lender’s fee for letting you use their cash. The lower the interest rate, the less you pay, leaving more money to fuel your business awesomeness. Why Interest Rates Matter So Much to Your Business A seemingly small difference in the interest rate can translate to thousands of dollars over the life of your loan. That’s money you could be reinvesting in your business, hiring new talent, or fueling that epic marketing campaign. The Factors that Influence Your Business Loan Interest Rate Lenders aren’t handing out cash like candy at a parade. They assess your risk as a borrower and set the interest rate accordingly. Here are the main culprits that affect your rate: Pro Tip: Don’t just focus on getting approved for a loan – focus on getting the best possible interest rate. A lower rate can significantly improve your business’s financial health over time. Negotiating Like a Boss: Strategies to Secure the Best Interest Rate Here’s where you transform from an interest rate novice to a loan-shark slayer: Pro Tip: Building a strong relationship with a lender can be beneficial. This allows you to establish trust and potentially negotiate slightly better terms on future loans. Beyond the Interest Rate: Other Loan Fees to Consider While the interest rate is a major player, it’s not the only cost associated with a business loan. Here are some other fees to be aware of: Remember: When comparing loan offers, consider the total cost of borrowing, not just the interest rate. Factor in all associated fees for a more accurate picture. The Takeaway: Don’t Be Afraid of Interest Rates, Conquer Them! Understanding interest rates is a crucial skill for any entrepreneur. By educating yourself and negotiating strategically, you can secure a business loan with a rate that fuels your growth, not hinders it. Bonus Tip: Consider consulting with a financial advisor who can help you business here

Benefits of Partnering with a Factoring Company

As a business owner, you know that cash is king. But what happens when your cash is tied up in unpaid invoices? This is where a receivables factoring company comes in. By partnering with a factoring firm, you can unlock hidden cash flow and keep your business running smoothly. Receivables factoring is a financing option that allows you to sell your unpaid invoices to a third-party company, known as a factor. In return, the factor advances you a large portion of the invoice value upfront, usually around 80% to 90%. The remaining balance, minus a small fee, is paid to you once your customer pays the invoice. The benefits of partnering with a receivables factoring company are numerous. First and foremost, it provides a quick injection of cash into your business, helping you cover immediate expenses and invest in growth opportunities. It also eliminates the need to wait for your customers to pay, giving you control over your cash flow. Additionally, factoring companies often provide valuable services such as credit checks on your customers, saving you time and reducing the risk of non-payment. Don’t let unpaid invoices hinder your business’s growth potential. Unlock hidden cash flow by partnering with a receivables factoring company today. How account receivables factoring works Receivables factoring is a financing solution that allows businesses to sell their unpaid invoices to a third-party company, known as a factor. This process provides businesses with an immediate influx of cash, rather than having to wait for their customers to pay their outstanding invoices. The way it works is simple. First, a business sells its unpaid invoices to the factoring company. The factor then advances the business a large portion of the invoice value, typically around 80% to 90%. The remaining balance, minus a small fee, is paid to the business once the customer pays the invoice. This fee is the factoring company’s compensation for providing the upfront cash and managing the credit and collections process. The factoring company takes on the responsibility of collecting the outstanding invoices from the business’s customers. This not only provides the business with much-needed cash flow, but it also frees up the business’s time and resources, allowing them to focus on their core operations. The factoring company utilizes its expertise in credit and collections management to ensure that the invoices are paid in a timely manner, reducing the risk of non-payment for the business. Benefits of partnering with a receivables factoring company Increased cash flow and working capital One of the primary benefits of partnering with a receivables factoring company is the immediate injection of cash into your business. By selling your unpaid invoices, you can access a significant portion of the outstanding funds, rather than having to wait for your customers to pay. This can be a game-changer for businesses that are struggling with cash flow issues or need to finance growth opportunities. With the additional working capital provided by the factoring company, businesses can invest in inventory, equipment, or other resources that can drive their growth and expansion. This can be particularly beneficial for small and medium-sized enterprises that may have limited access to traditional financing options, such as bank loans or lines of credit. Furthermore, the consistent cash flow provided by receivables factoring can help businesses better manage their financial obligations, such as payroll, rent, and supplier payments. This can ultimately lead to improved financial stability and the ability to take on new projects or customers without the worry of cash flow constraints. Stability and flexibility Partnering with a receivables factoring company can also help businesses improve their financial stability and flexibility. By selling their invoices, businesses can avoid the risk of customer non-payment or delayed payments, which can have a significant impact on their financial health. With the factoring company taking on the responsibility of credit and collections management, businesses can focus on their core operations without worrying about the administrative burden of chasing down late payments. This can lead to improved efficiency, reduced stress, and a more predictable cash flow. Additionally, the flexibility provided by receivables factoring can be particularly beneficial for businesses that experience seasonal fluctuations in their sales or have irregular cash flow patterns. By accessing a reliable source of working capital, these businesses can better navigate periods of low revenue or high expenses, ensuring they have the resources they need to maintain operations and seize new opportunities. Sourcing credit and collections management One of the key benefits of partnering with a receivables factoring company is the opportunity to outsource the credit and collections management process. Factoring companies have dedicated teams of experts who specialize in managing the credit and collections process, ensuring that invoices are paid in a timely manner. This outsourcing of credit and collections management can be particularly valuable for businesses that lack the internal resources or expertise to effectively manage this aspect of their operations. By handing over these responsibilities to the factoring company, businesses can free up their time and resources to focus on their core competencies, such as product development, sales, and customer service. Moreover, factoring companies often have access to advanced credit-checking tools and databases, allowing them to perform thorough due diligence on a business’s customers. This can help reduce the risk of non-payment and provide businesses with greater confidence in their customer base, ultimately leading to improved financial stability and growth potential. Financial advice and support In addition to the core services provided by receivables factoring companies, many also offer valuable financial advice and support to their clients. These experts can provide guidance on a range of financial matters, from cash flow management and budgeting to strategic planning and business growth strategies. By leveraging the expertise of the factoring company, businesses can gain a deeper understanding of their financial position and identify opportunities for improvement or expansion. This can be particularly beneficial for small and medium-sized enterprises that may not have access to in-house financial expertise or the resources to hire a dedicated finance team. Moreover, factoring companies

Boost Cash Flow with Factoring Loans

In today’s rapidly evolving business landscape, organizations constantly search for ways to optimize their cash flow and spur growth. One powerful tool that can help achieve these goals is factoring loans. Factoring loans provide businesses with an immediate influx of cash by selling their accounts receivable to a third-party financial institution, known as a factor. This arrangement allows companies to unlock the capital tied up in unpaid invoices, providing them with the working capital they need to expand operations, invest in new projects, or cover day-to-day expenses. But how exactly does factoring work? In this article, we will delve into the intricacies of factoring loans, exploring the benefits, drawbacks, and various types available to businesses. We will also discuss the ideal candidates for factoring, as well as provide tips for selecting a reputable factor. So whether you are a small business owner looking to strengthen your cash position or a financial professional interested in factoring as an investment opportunity, join us as we unlock the incredible potential of factoring loans. Understanding the concept of factoring loans Factoring loans are a unique financing solution that allows businesses to unlock the value of their outstanding invoices. Instead of waiting for customers to pay their bills, companies can sell their accounts receivable to a third-party financial institution, known as a factor. The factor then advances a percentage of the invoice value, typically 80-90%, providing the business with immediate access to much-needed working capital. This arrangement is beneficial for businesses that struggle with cash flow, as it enables them to convert their outstanding invoices into cash. The factor then takes on the responsibility of collecting the payments from the customers, charging a fee for their services. Factoring loans are particularly appealing to small and medium-sized enterprises (SMEs) that may not have the collateral or credit history to secure traditional bank financing. By leveraging their accounts receivable, businesses can free up funds to invest in growth opportunities, such as expanding their operations, purchasing new equipment, or hiring additional staff. Factoring also allows companies to avoid the lengthy and often frustrating process of chasing down late payments, as the factor handles all collection efforts on their behalf. This can lead to improved cash flow management and a more efficient use of resources, ultimately contributing to the overall financial health and success of the business. Benefits of factoring loans for businesses One of the primary benefits of factoring loans is the immediate access to working capital. By selling their outstanding invoices, businesses can quickly obtain the funds they need to cover expenses, invest in growth, or seize new opportunities. This can be especially valuable for companies that experience seasonal fluctuations in revenue or have customers with extended payment terms, as it helps to smooth out cash flow and ensure the availability of funds when they are needed most. Another significant advantage of factoring loans is the improved ability to manage accounts receivable. Factors take on the responsibility of collecting payments from customers, freeing up valuable time and resources for the business owner or finance team. This can lead to a reduction in administrative costs and the elimination of the need to chase down late payments, allowing the company to focus on its core operations and strategic priorities. Factoring also provides businesses with a flexible and scalable financing solution. As the company’s sales grow, the amount of available funding can also increase, enabling the business to keep pace with its evolving needs. This is particularly beneficial for companies experiencing rapid expansion or those with fluctuating cash flow requirements. Additionally, factoring loans do not typically require the same level of collateral or credit history as traditional bank loans, making them accessible to a wider range of businesses, including startups and those with limited access to traditional financing options. How factoring loans work The process of obtaining a factoring loan typically involves several key steps. First, the business identifies its outstanding invoices and selects the ones it wishes to sell to the factor. The factor then reviews the creditworthiness of the business’s customers and the overall quality of the invoices. Once the factor has approved the invoices, they will advance a percentage of the total invoice value, typically between 80-90%, to the business. This initial advance provides the company with immediate access to working capital. The factor then takes on the responsibility of collecting the full invoice amount from the customer, retaining a fee for their services, and remitting the remaining balance to the business. The fee charged by the factor is typically a percentage of the invoice value, ranging from 1% to 5%, depending on factors such as the size and creditworthiness of the business, the industry, and the volume of invoices being factored. It’s important to note that the factor’s fee is not the same as the interest rate charged on a traditional loan, as the factor is purchasing the invoices rather than providing a loan. Factors to consider when choosing a factoring loan provider When selecting a factoring loan provider, there are several key factors to consider to ensure the best fit for your business needs. One of the most important considerations is the factor’s industry expertise and experience. Look for a provider that specializes in your particular industry and has a track record of successful partnerships with businesses similar to your own. The factor’s pricing structure and fees are also crucial elements to evaluate. Compare the advance rates, factoring fees, and any additional charges across multiple providers to ensure you are getting a competitive and transparent deal. Some factors may also offer additional services, such as credit management or collections assistance, which can provide added value and convenience for your business. Another important factor to consider is the factor’s reputation and financial stability. Research the provider’s history, client testimonials, and industry standing to ensure they are a reputable and reliable partner. It’s also wise to assess the factor’s own financial health, as this can impact their ability to provide the necessary funding and support over