Accounts Receivable (A/R) Financing is a strategic financial solution that allows businesses to convert their outstanding invoices into immediate working capital. This innovative approach enables companies to access funds based on the value of their unpaid customer invoices, rather than waiting 30, 60, or even 90 days for payment.

A/R Financing offers numerous benefits, including improved cash flow, flexibility to scale with business growth, and the ability to take advantage of new opportunities without incurring traditional debt. It’s particularly valuable for companies experiencing rapid growth, seasonal fluctuations, or those dealing with extended payment terms from customers. This financial tool empowers businesses to bridge the gap between service delivery and payment receipt, ensuring smoother operations and fostering sustainable growth.

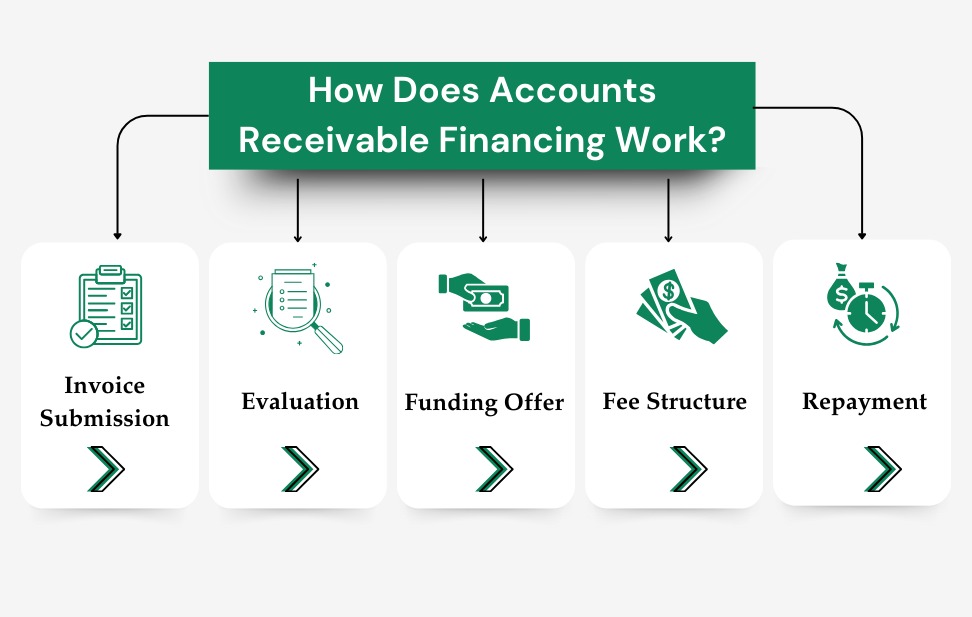

Accounts Receivable (A/R) Financing works by allowing businesses to use their unpaid invoices as collateral to secure immediate funding. Here’s a step-by-step breakdown of the process:

Application: The business applies for A/R financing with a lender, providing financial statements and details about their accounts receivable.

Approval: Upon approval, the lender establishes a borrowing base, typically 60-90% of eligible receivables.

Borrowing Base Certificate: The business submits a regular (often weekly) borrowing base certificate, detailing current eligible receivables.

Advance: The lender provides an advance based on the borrowing base, usually within 24-48 hours.

Repayment: As customers pay their invoices, the funds go to a designated account to repay the advance.

Revolving Credit: The credit line replenishes as invoices are paid, allowing for continuous borrowing for growth as new invoices increase.

Fees: The lender charges interest on the outstanding balance and may assess additional fees.

Accounts Receivable (A/R) Financing offers a multitude of benefits that can significantly impact a company’s financial health and growth potential. Let’s elaborate on these advantages:

Improved Cash Flow: By converting unpaid invoices into immediate working capital, businesses can maintain a steady cash flow. This ensures that companies have the funds necessary to cover operational expenses, invest in growth opportunities, and navigate financial challenges without disruption.

Flexibility and Scalability: A/R Financing grows with your business. As your sales increase and you generate more invoices, your borrowing capacity expands accordingly. This scalability allows companies to seize growth opportunities without being constrained by limited cash reserves.

No New Debt: Unlike traditional loans, A/R Financing doesn’t add new debt to your balance sheet. Instead, it leverages your existing assets (receivables), making it an attractive option for businesses looking to maintain a healthy debt-to-equity ratio.

Rapid Access to Funds: With A/R Financing, businesses can typically access funds within 24-48 hours of submitting a borrowing base certificate. This quick turnaround is crucial for addressing urgent financial needs or capitalizing on time-sensitive opportunities.

Improved Supplier Relationships: With consistent cash flow, businesses can pay suppliers on time or even early, potentially negotiating better terms or discounts. This can lead to stronger, more reliable supply chain relationships.

Enhanced Customer Relationships: A/R Financing allows businesses to offer more flexible payment terms to customers without compromising their own financial stability. This can be a competitive advantage in industries where extended payment terms are common.

Seasonal Business Support: For businesses with cyclical or seasonal fluctuations, A/R Financing provides a reliable source of working capital during slower periods, ensuring continued operations and preparedness for busy seasons.

Focus on Core Business: By outsourcing the management of receivables to the financing company, businesses can focus more on their core operations and growth strategies rather than chasing payments.

Credit Risk Mitigation: Some A/R Financing arrangements include credit insurance or non-recourse factoring, which can protect businesses from bad debt losses.

Credit Risk Mitigation: Some A/R Financing arrangements include credit insurance or non-recourse factoring, which can protect businesses from bad debt losses.

Financial Planning and Forecasting: The predictable nature of A/R Financing makes it easier for businesses to plan and forecast their financial position, enabling more informed decision-making.

Competitive Edge: With improved cash flow and financial stability, businesses can take on larger projects, invest in new technologies, or expand into new markets, gaining a competitive advantage in their industry.

By leveraging these benefits, businesses can not only survive but thrive, turning potential cash flow challenges into opportunities for sustainable growth and financial strength.

Costs typically include fees or discounts applied during the financing process, interest rates, and any additional charges from the lender. It's essential to evaluate these costs to understand the overall expense.

Eligibility varies by lender, but generally, businesses with outstanding invoices from creditworthy customers, strong sales history, and reasonable creditworthiness can qualify.

It can impact relationships if customers notice the business is relying on third-party collections. However, many financing companies work discreetly, and businesses can maintain good communication with their clients.

Yes, potential risks include high costs if not managed properly, reliance on financing instead of improving cash flow from operations, and possible negative effects on customer relationships if communication is not handled well.

California Department of Financial Protection and Innovation

Finance Lender/Broker License #607-1896

National Real Estate

NMLS #2252595