For seamless invoice factoring services, you can consult Asset Commercial Credit, as we have the expertise to convert your outstanding invoices into immediate cash. We are here to get you paid faster and boost your working capital to achieve your business goals.

Invoice Factoring is a quick financing option for businesses as it accesses cash by using unpaid customer invoices. This financing solution overcomes short-term cash flow needs by turning your small business’s outstanding invoices into cash. Business owners receive the funds within a few business days for immediate access to working capital with an invoice factoring service. However, the factoring company buying the invoice will deduct its fee, which is usually low, from your proceeds. Consecutively, to determine the factoring rate, a factoring company reviews an application to consider the following variables:

company’s sales volume

the credit strength of its clients

payment cycle trends in your industry

invoice amounts

the overall climate of your industry.

Also, your customers’ credit checks and contact references are performed to ensure creditworthiness. So, if you want to know more about the invoice factoring services of Asset Commercial Credit, contact us today and discuss this in detail.

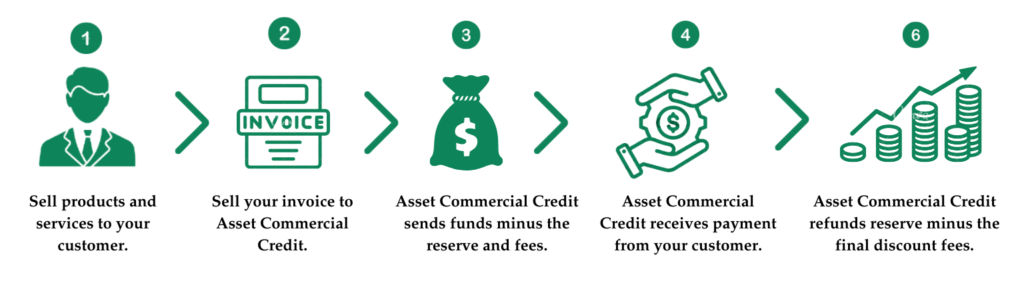

Before considering Invoice Factoring, learning more about the process involved is vital. So, to get help deciding whether factoring invoices is right for your business. Let’s understand with our experts what factoring is, its role, and how it will affect your customers.

The Invoice Factoring process typically involves three parties:

Your business

Your customers

The factoring company.

Submit Invoices: Instead of waiting for the customer to pay, you sell your outstanding invoices to the factoring company. Your business provides goods or services to your customers and issues invoices with payment terms.

Evaluation Process: The factoring company conducts an evaluation process to learn the creditworthiness of your customers as it helps us to determine your financing eligibility.

Immediate Funds: The factoring company pays you (a portion of), typically 70-90% of the invoice amount, within 24 hours and deducting the factoring costs after payment.

Customer Payment: Your customer pays the full invoice amount directly to the factoring company.

Hence, to ease your company from the frustration of chasing down payments from already-made sales, choose Asset Commercial Credit, a reputed Invoice Factoring and A/R Financing company, to weigh down your burden of maintaining your balance sheet of payments and getting cash flow to meet the future needs of your business.

Once your paperwork is submitted, financing is normally approved within 24 hours or less. Frequently, same day funding.

Any business offering goods or services to other companies can use invoice factoring. Mostly provided to B2B businesses due to the size and volume of their invoices.

Costs are dependent on the amount of money needed, the creditworthiness of your customer(s), how many customers you have to factor and the frequency of funding with Asset Commercial Credit. We offer free proposals to all potential clients.

Asset Commercial Credit offers financing nationwide and can also work with foreign owned U.S. subsidiaries.

Yes, once your company issues an invoice to their customer, we can provide funding. We assist startup businesses in the growth or expansion phase. These startups have already acquired customers, are actively expanding their customer base, generating revenue, and scaling their operations to increase market share.

No, you can submit a portion of your invoices based on the financing needs of your business.

Your business can submit invoices whenever cash is needed.

A notice of assignment is sent directly with all the information through the factoring company.

California Department of Financial Protection and Innovation

Finance Lender/Broker License #607-1896

National Real Estate

NMLS #2252595